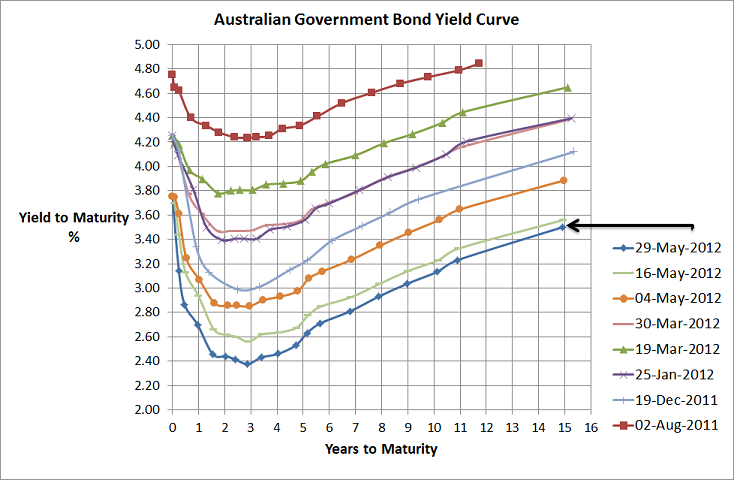

Source: RBA

I know I’ve written more posts on the Australian Government Bond Yield than ever but with the yield curve hitting record lows its pretty hard to ignore. The above chart shows where the yields finished yesterday and today they’re lower again.

The European situation is definitely the main driver as funds move to this safe haven. The Australian government is AAA rated, contrary to the spin of the opposition party, Australia does have a very low level of government debt, and given these low risk factors its no wonder these bonds are popular in the face of potential economic calamity.

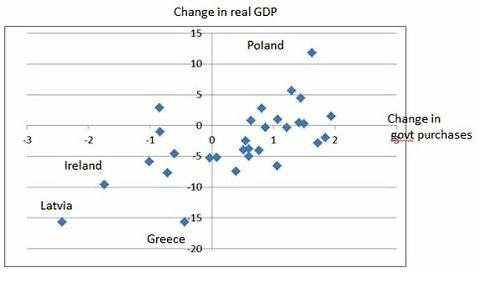

Let’s face it, the Euro is pretty much finished. It might take a while but the Euro experiment is a failure and the requirements to fix it appears too much of a paradigm shift for the Germans and others to save it. The current strategy of a monetary union combined with austerity (with a desire for wage deflation) will only spiral economies into deeper recession. To rescue the peripheral countries from this recession requires a kickstart that can only be achieved with a fiscal expansion (don’t forget the biggest fiscal expansion in history, WWII, rescued the world from the Great Depression) and/or targeted inflation…the complete opposite of the current failing approaches.

Source: http://krugman.blogs.nytimes.com/2012/02/18/austerity-and-growth/

Fiscal expansion controlled from a centralised body is what countries like Australia and USA can do when states are in trouble and the redistribution of wealth is a necessary requirement for Europe to reverse the peripheral countries’ situations…unfortunately I don’t believe a Unites States of Europe can ever get off the ground in the way that is required.

A high inflation target will help reduce the spiralling debts in real terms but when you consider the paranoia around inflation, evidenced by Germany’s hyperinflation history and the ECB’s ridiculous interest rate rises last year, its also very hard to see how this paradigm shift and change in focus will occur.

Greece will exit the Euro and the drachma will be back. That will create significant pain for Greece who will default on everything, the banks who will need recapitalising and the economy which will sink to new lows before growth restarts…at least it will restart earlier than if things continue as is. The big concern though, is that markets will then see the Greek Exit as a possibility for the other peripheral countries, who may ultimately need to exit if the austerity strategy continues, and that’s when the contagion and panic could really begin. Don’t forget that there are trillions and trillions of derivative contracts linked to the Euro and peripheral country debts and noone really knows where the ultimate risk lands. There is a lot of other stuff that is likely to occur and I haven’t even scratched the surface but the bottom line is that Lehman Brothers is not guaranteed to be the biggest contagion event this century.

I know I’ve painted a pretty ugly picture…I hope I’m wrong…but the above scenario is a greater possibility than many realise. Even if I’m wrong, the European situation and ongoing blow-ups still continues for years and years. The downside risk to growth portfolios is currently significant, and the upside potential isn’t that great. I’m currently a strong believer in being underweight equities, and overweight cash (RBA may drop another 50bps) and bonds…but am still a believer in diversification so still holding all major asset classes…and am more than happy to be wrong!