A look at the average returns of bonds over the last 30 years does not suggest that equity returns have really been worth the risk. Table 1 shows the returns on Australian Bonds (Aust Comm Bank All Series/All Maturities) versus the accumulated return of the Australian sharemarket (S&P/ASX 200 TR) and whilst equities have the better performance over 30 years its hard to imagine the additional 1.53%pa return has been worth the additional risk.

Table 1

Source: iRate van Eyk Research

Looking ahead many investors will see these returns and conclude that bonds are a better investment than shares, but unfortunately they won’t be looking at the full picture.

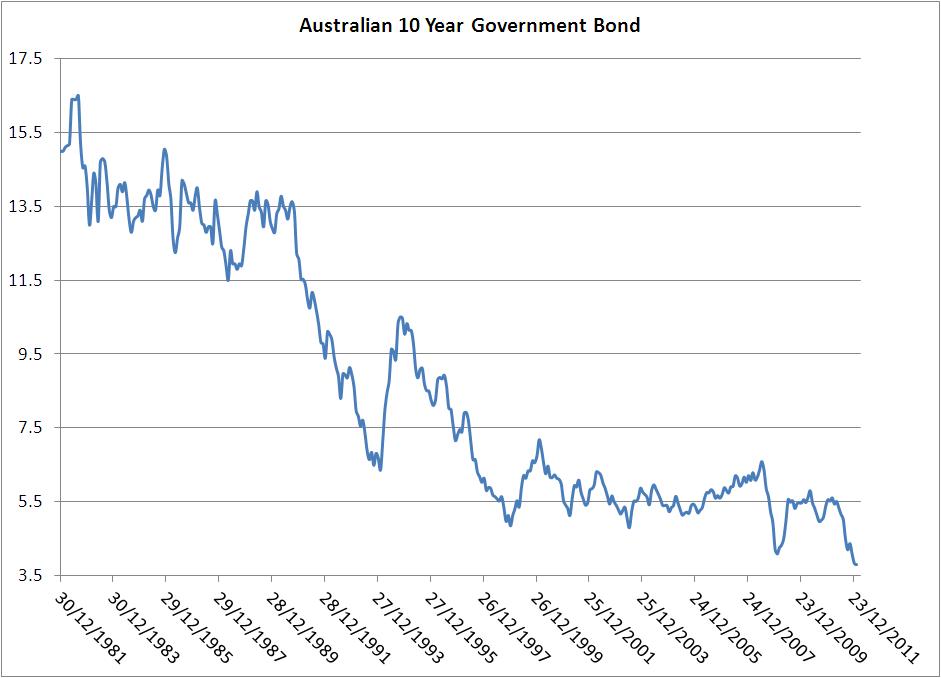

The below chart shows exactly what has happened to long term interest rates over the last 30 years and the trend is pretty obvious…its significantly down. So 30 years ago, an Australian 10 year government bond was yielding around 16.5% and now it yields below 4% which is a significant drop. This means that over this time there has been a strong capital gain by holding bonds (when interest rates drop, bond prices go up) so the question is, will this trend continue?

Whilst it is absolutely possible that longer term interest rates (or yields) continue to drop, evidenced by Japan, US, UK and Germany whose 10 year bonds are 2%pa at most, over the longer term you would have to expect that return potential favours equities.

As I mentioned in an earlier post, the forward expectation of returns over the next 5 year for a bond fund is approximately the 5Year bond yield plus around 0.5% of credit risk, which equates to somewhere between 4% & 4.5%.I’m pretty confident that for the market as a whole that is not a particularly attractive return so the ongoing attractiveness of bonds may be challenged.

Whilst I do believe, that the macro economic risks should keep the prudent investor underweight risky assets for the moment, I am failing to see a compelling story in favour of boring old bonds. Term deposits are offering a very nice margin for the retail investor and corporate credit (for non-banks) appears attractive given cashed-up corporate balance sheets, but traditional asset allocation models are looking a little challenging.

The one issue that is in the back of my mind in favour of bonds, despite the macro risks, are potential structural changes in the Australian superannuation system. MySuper may result in far more conservative default funds as trustees realise the balanced fund is completely inappropriate, and the transfer out of the old default funds could be sped up by the introduction of superstream as well as the mass retirement of the baby boomer segment. Either way, the average Australian super fund carries a little more risk than it possibly should so I expect it to change over the years to come.

Back to my main point…equities look frightening, bonds look expensive, and cash is on the way down…its time to start looking at some non-traditional (sub) asset classes to diversify into.